capital gains tax indonesia

Indonesia Highlights 2022 Page 2 of 10 Corporate taxation Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax rate 22 standard ratevarious Residence. Spains General Tax Law LGT allows them to demand a refund of the municipal capital gains tax from the non-resident seller.

Introduction To Taxation In Indonesia Acclime Indonesia

A company is regarded as Indonesian tax resident if it is established or domiciled in Indonesia or if its place of.

. An additional tax of 05 applies to the share value of founder shares at the time of an initial public offering. They have owned it for 10 years. You should research the rules that CRA uses to determine your tax residence.

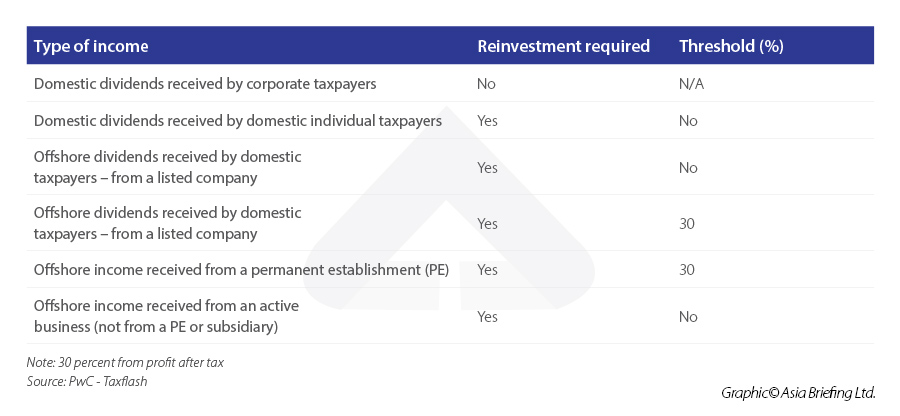

The transfer of titles to land and buildings under an asset purchase subjects the seller to a 25 percent final income tax and subjects the buyer to a 5 percent transfer of title tax duty. Capital gains taxes. However the Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax subjects by reason of becoming tax resident in Indonesia can be taxed only on.

Pajak atas capital gain adalah pajak tambahan penghasilan yang harus dibayarkan untuk pajak terutang pada periode pajak tahun selanjutnya. Taxes on crypto have been facing backlash from the. Sale of land andor buildings located in Indonesia.

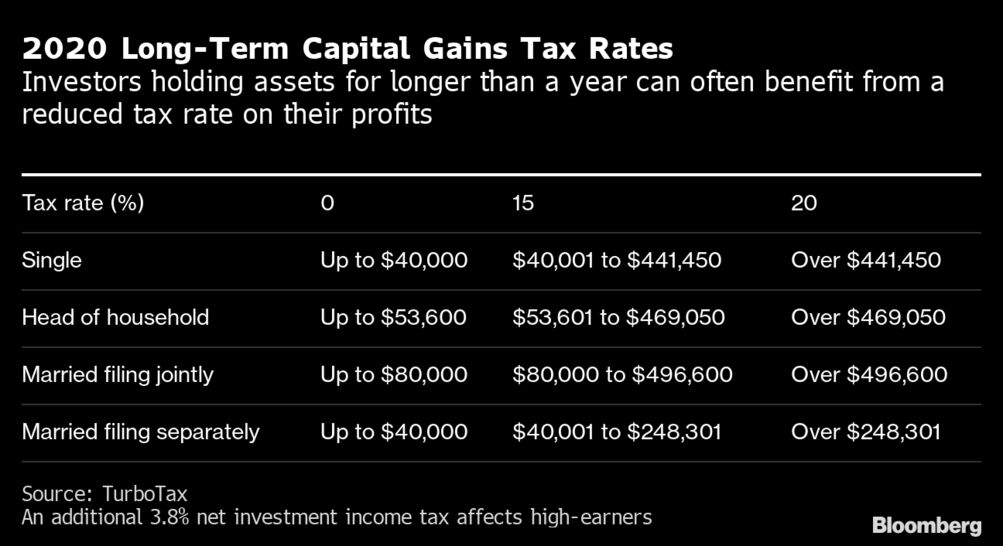

The valued-added and capita-gains taxes will take effect on May 1. For example the Inflation Reduction Act would expand Section 1061 to cover qualified dividend income generally taxed at long-term capital gain rates. Indonesian tax residents are required to file annual individual tax returns when their total income derived from sources within and outside of Indonesia exceeded the minimum threshold which is between IDR54000000 for a single individual and IDR72000000 for a married individual with three childrendependents effective 1 January 2016.

However gains from the transfer of land and buildings are not subject to regular CIT but rather are subject to final income tax at a rate of 25 of the transaction value or the government-determined value whichever is higher. Sedangkan investasi jangka panjang dalam barang koleksi dikenai pajak pada flat 28. Adapun besarnya pajak capital gain properti tersebut yaitu.

CGT is often associated with buying and selling property but it can also apply to other kinds of assets including. Besar Pajak Rp 15000000000 x 15 Rp 2250000000. This however is a.

Indonesia plans to charge value-added tax VAT on crypto transactions and capital gains at a rate of 01 starting May 1. Capital gains taxes apply only to capital assets which include stocks. Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual.

The taxes will come into effect from May 1. Capital gains derived by an individual are taxed as ordinary income at the normal rates. Share deal Capital gains received by an entity in a share deal are subject to corporate income tax of 25 while capital gains received by an individual are subject to individual income tax in the range of 5 until 30.

It violates the uniformity requirement by imposing a 7 tax on an individuals long-term capital gains exceeding 250000 but imposing zero tax on. 5 hours agoThe Inflation Reduction Act would recharacterize certain types of income that is currently subject to long-term capital gains tax rates to short-term capital gains. The property is directly and jointly owned by husband and wife.

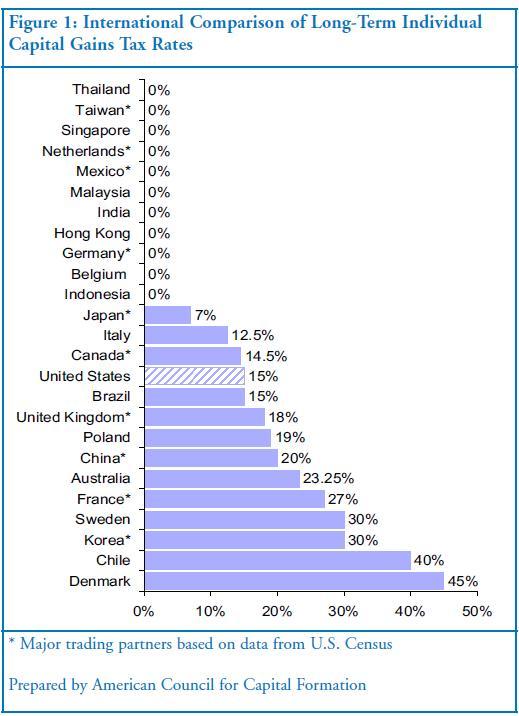

It is their only source of capital gains in. Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction value. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions.

01 of the gross transaction value. Cara Melaporkan Pajak Penghasilan PPh Pasal 22. Sedangkan capital gain jangka panjang dalam barang koleksi dikenai pajak pada flat sebesar 28.

The settlement and reporting of the tax due is done on self-assessed basis. The sale of shares listed on the Indonesian stock exchange is subject to a final tax at 01 percent of gross proceeds. Gains on the disposal of land andor.

Indonesia introduced a 01 VAT and capital gains tax on crypto transactions and investments. In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. If the seller is non-Indonesian tax resident a 5 capital gains tax final due on the gross transfer value which has to be.

Di tahun 2015 capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 untuk pajak penghasilan 10 dan 15 15 untuk pajak penghasilan 25 sampai 35 atau 20 untuk 396 pajak penghasilan. Conversely a capital loss occurs when you sell an asset for less than what you paid. Capital gains tax also known as CGT is a type of tax paid when you sell an asset for more than you bought it for.

For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. Really curious as Canadian taxes are fairly high around 50 of capital gains are taxable at 50 and short term gain are 100 are taxable at around 50. 26 WHT of 20 is applicable.

The tax is 5 final tax or 25 from 8 September 2016 on the taxable. Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. 80 rows Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals.

A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs.

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax

Capital Gains Tax Would Buffett Prefer To Live In Holland

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Forex Trading Academy Best Educational Provider Axiory

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

A Tax Dilemma How Capital Gains Can Hold Financial Advisors Hostage Nasdaq

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

Capital Gain Tax Stock Photos Royalty Free Images Vectors Video Capital Gains Tax Capital Gain Tax

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Top 8 Things To Know About Taxes For Expats In Indonesia

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg