oklahoma auto sales tax rate

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. An example of an item that exempt from Oklahoma is.

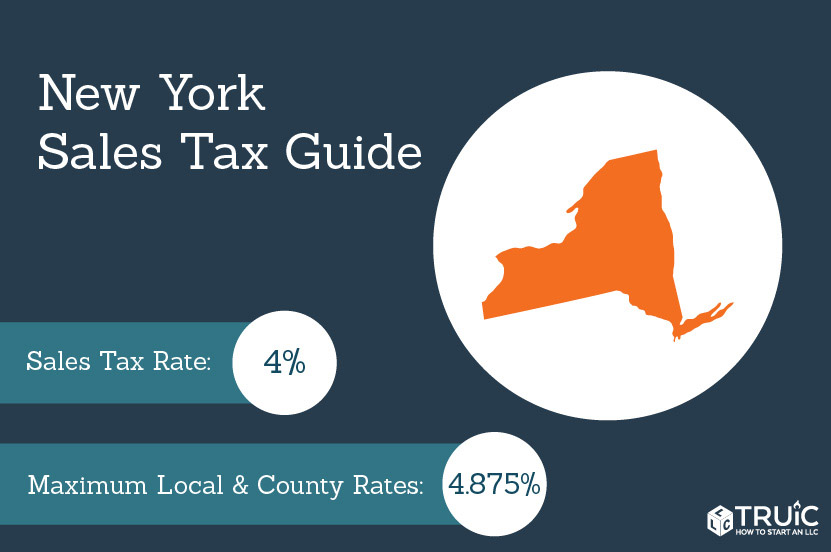

Certificate Of Authority New York Sales Tax Truic

Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes.

. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. 325 of taxable value which decreases by 35 annually. There are special tax rates and.

However it must be noted that the first 1500 dollars spent. The sales tax rate for the Sooner City is 45. The Motor Vehicle Excise Tax on a new vehicle sale is 325.

Content updated daily for oklahoma sales tax rate. Oklahoma tax commission 0188 adair cty 175 0288 alfalfa cty 2 0388 atoka cty 175 0488 beaver cty 2 0588 beckham cty 035 0688 blaine cty 0875 0788 bryan cty. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Oklahoma Sales Tax on Car Purchases. Wilburton Talihina Red Oak Panola and Gowen.

Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad. Oklahoma has state sales tax of 45 and.

Simplify Oklahoma sales tax compliance. 5513 Luther 3 to 4 Sales and Use Increase October 1 2021 0114 Stillwell 35 to 375 Sales and Use Increase October 1 2021 3388 Jackson County 0625 to 1125 Sales and Use. However it must be noted that the first 1500 dollars spent.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. With local taxes the total sales tax. Lowered from 625 to 6.

Find your Oklahoma combined. Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325.

Counties and cities can charge an. Exact tax amount may vary for different items. We provide sales tax rate databases for businesses who manage their.

Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle. Oklahoma Sales Tax on Car Purchases. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Ad Looking for oklahoma sales tax rate. 608 rows Average Sales Tax With Local.

31 rows The state sales tax rate in Oklahoma is 4500. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that. 325 of ½ the actual purchase pricecurrent value.

The base state sales tax rate in Oklahoma is 45. This is the largest of Oklahomas selective. In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle.

Oklahoma Tax Commission Oktaxcommission Twitter

Used Cars And Trucks For Sale In Okc Bob Moore Auto Group

Volkswagen Vehicles Enterprise Car Sales

Oklahoma Tribal License Plates Choctaw Vehicle Tags Choctaw Nation Of Oklahoma

Tesla Sales Model Comes Under Scrutiny From Lawmakers The Journal Record

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Used Gmc Yukon Xl For Sale In Oklahoma City Ok Cargurus

Oklahoma Tax Commission Oktaxcommission Twitter

Oklahoma Title Transfer Etags Vehicle Registration Title Services Driven By Technology

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax What S My Responsibility Grow Your Estate Sale Company

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Oklahoma Tax Commission Oktaxcommission Twitter

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Volkswagen Vehicles Enterprise Car Sales

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy